life insurance policy for parents

If you do not have elderly parents kids or you are not married and will never get married. In exchange for relatively low rates your beneficiaries get a tax-free lump sum of money after you die.

Should You Buy Life Insurance For Your Parents Prudential Financial

While some other types of life insurance policy offer maturity benefits term insurance does not.

. It lasts for a fixed period of time typically 10 to 40 years depending on your policy which is all that most people need. In a life insurance policy if you do not pay the premium on time the. Only if you pay the premium the policy cover remains in effect.

Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end. Simply if there is nobody that depends on you financially then life insurance may not be essential for you. A type of life insurance with a limited coverage period.

Other coverage amounts over 300000 are available up to 1000000. These plans also qualify for an additional Rs. A life insurance policy is an agreement between an insurance company and a policyholder where the life insurer promises to pay a fixed amount of money in return for a premium after a set time period or upon the life assureds death.

Term life insurance is the most affordable type of life insurance policy. 50000 if parents are senior. Benefits under life insurance policy that shall be receivable by the life insured or the nominee also qualify for tax exemptions under Section 1010D of the Income Tax Act.

The cost for a 10-year term 1 million. What is Life Insurance Policy. The named beneficiary receives the proceeds and is thereby safeguarded from the.

Or they might like the tax-advantaged growth on the cash. 2 Medical exam is required for age 51 and over and who apply for more than 100000 in coverage. Call one of our friendly representatives for rates 1-866-503-4480.

Life insurance is a protection against financial loss that would result from the premature death of an insured. We analyzed term life insurance quotes for 1 million policies to determine the average cost. 1 Premium based on a 100000 20-year Term Life policy for a healthy 18-year-old female paid by automatic monthly deduction from a checking or savings account.

For example high-income parents might find the ability to transfer wealth to their children through a life insurance policy appealing. There are two simple types of life insurance policies. 25000 tax deduction for premium paid for parents mediclaim policy Rs.

How Much Does a 1 Million Term Life Insurance Policy Cost. The term insurance plan is one of the most sought-after types of life insurance policies in India. This is one of the types of life insurance policy in India that you can buy for a specific period of 10 20 30 or more years hence the name.

:max_bytes(150000):strip_icc()/haven-life-96bc99dd54554c81804ac063726282cf.jpg)

Best Life Insurance For Parents Of 2022

Finding The Right Life Insurance Fit Is The Best Policy

Quility Insurance For All Those New Parents Out There Looking To Catch Some Zzz S Tonight Here S How A Life Insurance Policy Can Help You Get Peace Of Mind And Sleep More

Life Insurance For A Stay At Home Mom Bestow

Advice For Buying Life Insurance On Your Parents

Did Your Parents Give You A Whole Life Insurance Policy Here S What To Do With It

10 Types Of Life Insurance Policies Pick A Policy That Works Best For You

10 Tips For Buying Life Insurance For Parents Avoid Taxes

4 Reasons Why Indexed Universal Life Is A Good Investment For Children

Best Life Insurance For Parents Of 2022

Family Life Insurance Life Insurance For Parents And Children Quotacy

30 Insurance Ideas Insurance Life Insurance Quotes Insurance Marketing

The Best Life Insurance For Parents From 7 92 A Month 2022

What Should I Do With The Whole Life Insurance Policy My Parents Bought When I Was A Kid Yqa 131 2 Youtube

Life Insurance Policy For Parents Top 5 Considerations

Permanent Life Insurance Whole Life Policy Knights Of Columbus

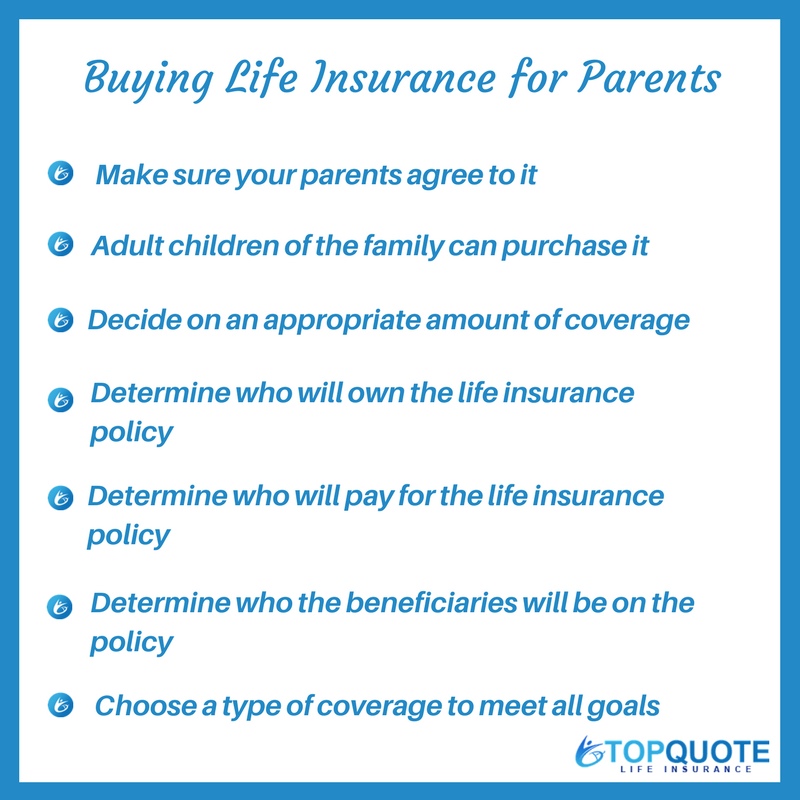

Buying Life Insurance For Parents What Steps You Need To Know Top Quote Life Insurance

Life Insurance For California Surrogate Mothers Masler Surrogacy Law California Surrogacy Attorneys